Council Tax news

Council Tax – Autumn Budget November 2025

During the autumn budget (November 2025), the Chancellor announced a High Value Council Tax Surcharge (HVCTS): HVCTS in England for residential properties worth £2 million or more in 2026, taking effect in April 2028.

Full details regarding the administration of this HVCTS have not yet been shared with local authorities.

Our understanding is that this charge will be:

- based on updated valuations. The Valuation Office Agency (VOA), who are responsible for the valuation of Council Tax properties, will conduct a targeted valuation exercise to identify properties above £2 million and therefore in scope. Fewer than 1% of properties in England are expected to be above the £2 million threshold. Revaluations will be conducted every five years.

- in addition to existing Council Tax

- levied on property owners rather than occupiers

- collected by local authorities on behalf of central government

- New charges to start at £2,500 per year, rising to £7,500 per year for properties valued above £5 million as follows:

- Properties valued from £2m to £2.5m will pay £2,500

- Properties valued from £2.5m to £3.5m will pay £3,500

- Properties valued from £3.5m to £5m will pay £5,000

- Properties valued at more than £5m will pay £7,500

- The government will consult on detailed implementation of the HVCTS in the new year, including to determine who might need additional support to pay the charge and how to deliver it.

Additional information can be found on the Gov.uk website.

Scam alert: fraudulent Council Tax emails

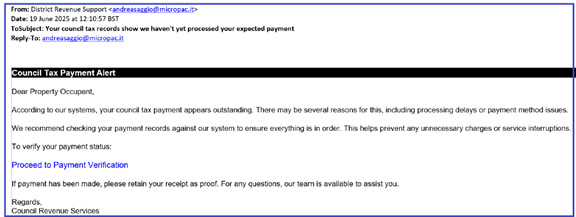

We have been made aware by the National Anti-Fraud Network (NAFN) of a scam currently targeting residents. Fraudsters are sending emails that appear to come from Local Authorities, falsely claiming that a Council Tax payment is overdue.

These emails are designed to trick recipients into clicking a link that asks them to verify their payment details or check the status of their Council Tax account. This is a phishing attempt aimed at stealing personal and financial information.

What the scam looks like

The fraudulent email may look like this:

What you should do

- Do not click on any links in suspicious emails.

- Do not provide any personal or financial information.

- Report the email to us and to report@phishing.gov.uk.

- If you’re unsure about your Council Tax status, contact us directly using official contact details that can be found on your Council Tax bill.

Stay vigilant

Always verify the source of any unexpected communication regarding payments.

If you believe you’ve been targeted or have already clicked on a suspicious link, contact your bank immediately and report the incident to Action Fraud.

Be aware of paid adverts in search results

When searching online for Council Tax services, you may see adverts at the top of Google or other search engines. These are paid listings from third-party companies that may charge you for services that we provide free of charge.

Council Tax change of circumstances - current processing

We are currently experiencing a high volume of enquiries, which is causing delays in updating some Council Tax accounts. To help us manage this, please avoid contacting us or sending duplicate enquiries. Our backlog is currently around six weeks.

We sincerely apologise for any inconvenience this may cause and assure you that we are working diligently to respond as quickly as possible.

Thank you for your patience and understanding.

Council Tax text and email messaging service

If you ever find yourself falling behind on your Council Tax payments, we are here to help! We will send you a friendly reminder and reach out via SMS text and/or email to provide useful information on payment options and support for those who may need assistance. For more details, visit the Council Tax text and email messaging service page.

Second home premium

From 1 April 2025 a premium will be applied to properties that are classed as second homes.

For council tax purposes second homes are properties that are furnished but where no-one lives as their main residence.

Further information can be found on the Council Tax for empty properties and second homes page.

HMRC / Council Tax scam

We are receiving reports of an email HMRC/Council Tax scam. Be aware and be vigilant especially online. Do not give any bank details via email or over the telephone to cold callers. If you are suspicious report it at: gov.uk - report suspicious emails.

We have changed our bank account from Barclays to Lloyds

We have changed our bank account from Barclays to Lloyds. As the Barclays account is now closed, payments made quoting the old bank details will not be successful and any attempted payments will either fail at the point of entry, or be returned to the sender. For payment information see paying your Council Tax.

Council Tax enquiry form

If you're unable to use our forms or have any questions about your bill you can call the Council Tax Customer Service Team on 0300 123 5013 between 8:30am to 4pm, Monday to Friday, excluding bank holidays.

Page last reviewed: 14 January 2026

Thank you for your feedback.