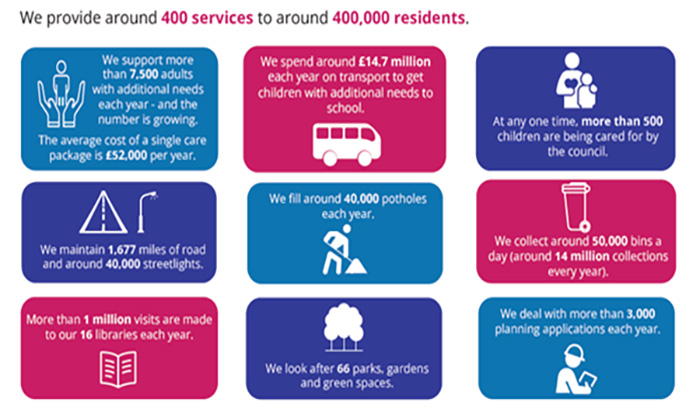

- We provide around 400 services for 400,000 residents

- We support more than 7,500 adults with additional needs each year - and the number is growing. The average cost of a single care package is £52,000 per year.

- We spend around £14.7 million each year on transport to get children with additional needs to school.

- At any one time, more than 500 children are being cared for by the council.

- We collect around 50,000 bins a day (around 14 million collections every year).

- We maintain 1,677 miles of road and around 40,000 streetlights.

- We fill around 40,000 potholes each year.

- More than 1 million visits are made to our 16 libraries each year.

- We collect around 50,000 bins a day (around 14 million collections every year).

- We deal with more than 3,000 planning applications each year.

- More than 1 million visits are made to our 16 libraries each year.

- We look after 66 parks, gardens and green spaces.

Social care is funded through council tax - not by the NHS.

The cost of providing care is rising sharply, and demand for these essential services is growing faster than the funding available.

Without council funded social care, pressure on local hospitals would increase significantly.

This report provides detailed information on the issues facing the council in the medium term and shows how these are being addressed to present a balanced financial position for the 2026/27 financial year.

The strategy includes:

- How your council is funded (such as government grants, business rates and council tax)

- The budget for each committee and plans for the next four years

- Capital investment plans

- Strategies for reserves, investment, and treasury management

We have built £25 million in Exceptional Financial support into the budget for 2026/27, which is equivalent to 5% of the budget. Exceptional Financial Support does not mean we get cash from government. It means we are allowed to borrow, or use income from sale of assets, to close the funding gap.

Borrowing means taking on a long-term commitment to pay interest. So, it’s a short-term fix to give us more time to build long-term financial sustainability.

We are committed to delivering the best possible services, protecting our most vulnerable residents and ensuring our borough is an even better place to live, work and thrive.

However, this has become increasingly difficult. Demand in areas such as children’s social care, adult services and special educational needs are growing faster than our funding.

We are in the process of transforming and adapting to meet these challenges. Our Improvement and Transformation Delivery Plan sets out our priorities and what we need to do. This includes reviewing all the services we deliver, the resources, tools and processes we use, the jobs we all do and the way we are organised.

We have now reviewed the scale, timing and delivery of our transformation programmes for the coming years, including how and when we will realise transformation savings.

- Some services must be delivered differently and more efficiently.

- Others will need to reduce or stop altogether.

- And we will work with partners to find new ways of meeting local needs.

We are addressing our challenges with a focus on delivering value for money, continuous improvement and better outcomes for Cheshire East’s residents.

We are confident that with the right resources, focus and commitment, we can deliver the actions in our plan at the pace required, resulting in real improvements and a sustainable financial position for the long term.