Value for Money 2020 - 2021

Guidance and Data on the Financial Resilience of the Council

Cheshire East Council has updated a key document to demonstrate its strong financial position.

Cheshire East Council is the third largest council in the Northwest of England and is responsible for delivering more than 500 local public services across an area of over 1,100km2 for over 380,000 residents. The budget to deliver these services in the period April 2020 to March 2021 is over £800m (with a balanced net budget for 2020/21 of £301m), which is raised from a combination of local taxes (business rates and council tax), national taxes (in the form of Government Grants) and payments direct from service users.

The complexity of customer demands and the size of the organisation make it very important to manage performance and control expenditure to ensure the best outcomes for residents and businesses.

Strong Financial Performance

The overall financial health, performance, resilience and value for money at Cheshire East Council is strong, and savings are consistently achieved through efficiency, removing duplication of effort, making reductions in management costs, and planned programmes of asset disposals. The approach continues to protect funding provided to front line services.

The Council has robust billing and collection procedures for local taxation this is demonstrated by high, sustained collection rates from its relatively high domestic and non-domestic taxbases.

Value for Money - headlines

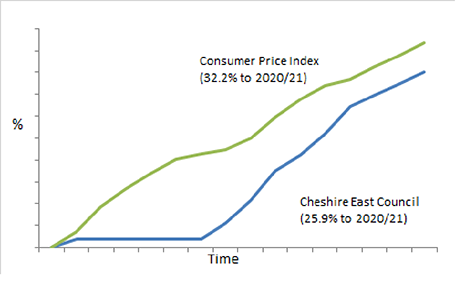

Council Tax Levels have been controlled and inflationary pressures managed.

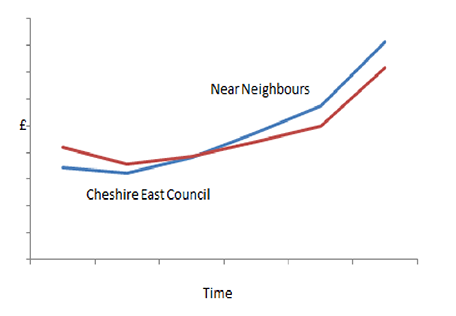

Core Spending Power was below comparator levels but has now crept above comparator authorities as our Council Tax band D charge has increased over recent years to keep up with demand in services. Grant funding is still less than similar authorities.

Funding sources are changing in line with Government expectations to place more reliance on local sources of funding.

Further information

Page last reviewed: 28 February 2024

Thank you for your feedback.