Council Tax budgets and spending

Elected councillors agree a budget each year that shows how much money we will need for the services we will be providing, and where the money will come from. Council Tax has to make up the difference between the amount we receive from other sources and the total it costs us to provide our services. This difference is called the Council Tax requirement.

Council Tax bills also include charges from local town and parish councils (PDF, 105KB), Cheshire Constabulary, and Cheshire Fire Authority. Each of these organisations sets their own budget for the services they provide. Where a Town or Parish Council plans to raise more than £140,000 they must publish details of their gross expenditure.

Council Tax budget summary 2025-26

For 2025-26, the budgets to be met from Council Tax in the Cheshire East Council area are:

Council Tax budget summary

| Authority | 2025-26 | 2024-25 |

|---|

| |

£m |

£m |

| Cheshire East Council |

307.264 |

287.086 |

| Police and Crime Commissioner for Cheshire |

45.214 |

42.110 |

| Cheshire Fire Authority |

15.524 |

14.428 |

| Town and parish councils |

12.822 |

11.462 |

We have increased Council Tax by 4.99% for 2025-26.

There are three reasons for this year's increase:

- there is continuing growing demand for social care

- the costs of providing services have risen due to exception inflation levels

- we continue to have extremely low levels of general revenue support grant (£0.8 million allocated for 2025-26)

Business growth is helping to bring in more money from Business Rates, and the growth in house building should mean more Council Tax payers and higher Council Tax income. But it will still be a major challenge to raise the amount of money to cover what's needed.

Changes between the 2024-25 and 2025-26 budgets

We need to raise £21.5 million more from Council Tax including town and parish charges in 2025-26 than we did in 2024-25. This is due to exceptional inflation and higher demand for key services.

Changes between the 2024-25 and 2025-26 budgets

| Income or expenditure category | Change to Council Tax requirement between 2024-25 and 2025-26 |

|---|

| |

£m |

| Increased net growth in service demand and inflation pressures |

16.6 |

| Increase in Specific Grant (including Revenue Support Grant) |

-6.0 |

| Increase in Business Rates |

-0.5 |

| Increased town and parish council charges |

1.4 |

| Change in central budgets (including Exceptional Financial Support) |

10.0 |

| Total |

21.5 |

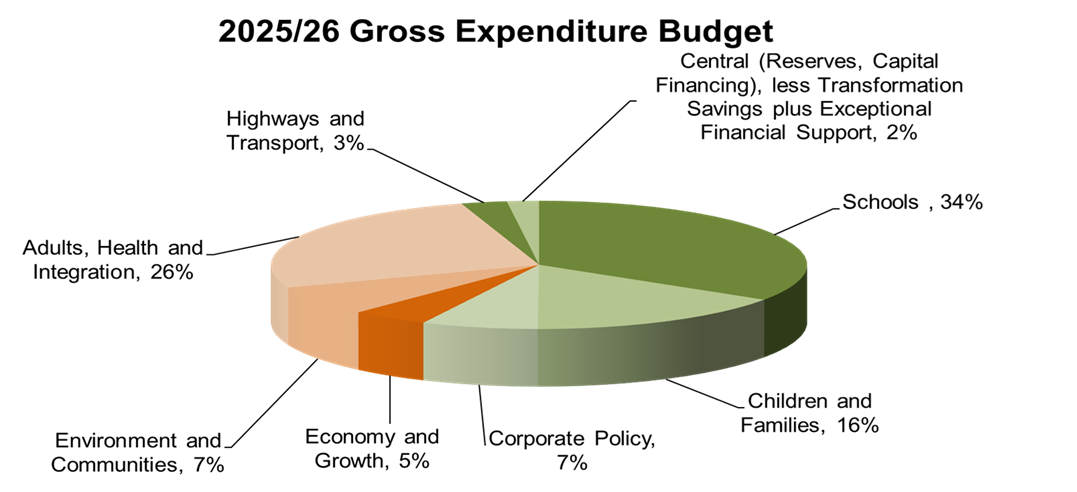

How we spend our income

We split our services into service committee areas.

Spending by service committee area

Breakdown of income and expenditure by service committee area

Breakdown of income and expenditure by service committee area

| Area of spending | 2025-26 gross expenditure (amount of money needed) - A | 2025-26 service specific income (not from Council Tax or Business Rates) - B | 2025-26 net expenditure (amount needed after deducting service-specific income) - C | 2024-25 net expenditure (amount spent after deducting service-specific income) - C |

|---|

|

£m |

£m |

£m |

£m |

| Schools |

208.824 |

-208.824 |

0.000 |

0.000 |

| Adults and Health Committee |

252.154 |

-92.705 |

159.449 |

137.442 |

| Children and Families Committee |

107.383 |

-10.095 |

97.288 |

88.963 |

| Corporate Policy Committee |

108.802 |

-66.014 |

42.788 |

41.656 |

| Corporate Policy Committee - Council Wide Transformation Savings |

-12.702 |

-0.750 |

-13.452 |

41.656 |

| Economy and Growth Committee |

38.144 |

-9.703 |

28.441 |

27.942 |

| Environment and Communities Committee |

68.964 |

-23.263 |

45.701 |

48.649 |

| Highways and Transport Committee |

28.370 |

-11.469 |

16.901 |

15.830 |

| Finance Sub Committee (Central budgets, Reserves and Capital Financing) |

54.012 |

-3.492 |

50.520 |

15.227 |

| Exceptional Financial Support (D) |

0.000 |

-25.261 |

-25.261 |

0.000 |

| Total - E |

853.951 |

-451.576 |

402.375 |

417.365 |

Notes

A - The gross expenditure columns shows what we plan to spend in 2025-26

B - Service-specific income includes income from:

- grants that can only be used for the particular service

- fees and charges for services

- other external contributions for the particular service

C - The net expenditure figure is the amount left after deducting the sum in the income column. This is the amount of money we need to cover from general income. General income comes from Council Tax, Business Rates and government grants.

D - Exceptional Financial Support - see Cheshire East Budget - Medium Term Financial Strategy for further information.

E - The totals line shows that after taking into account income we receive for specific spending areas, we still need to raise £402.4 million to cover the costs of services. This money has to come from general income - Council Tax, Business Rates and central government grants.

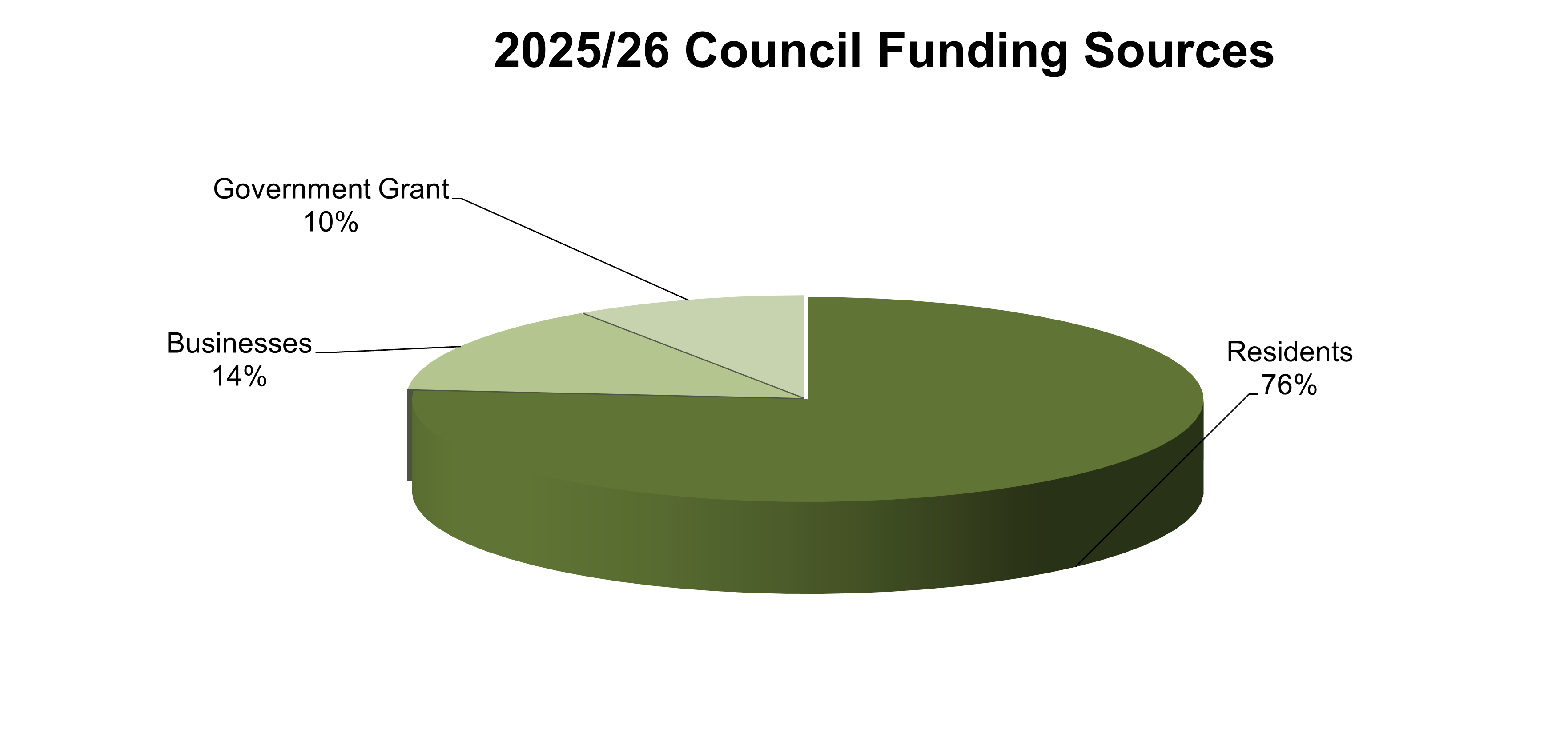

Sources of general income

Sources of general income

| Source of income | Amount 2025-26 | Amount 2024-25 |

|---|

|

£m |

£m |

| Business Rates retained |

57.122 |

56.627 |

| Revenue support grant (central government) |

0.849 |

0.414 |

| Specific grant (central government) |

37.140 |

31.582 |

| Cheshire East Borough Council Tax |

307.264 |

287.086 |

| Total general income |

402.375 |

375.709 |

Capital spending

Capital spending

Our ongoing programme of capital investment includes investment in assets such as roads, land and buildings, equipment and vehicles.

We often spread the costs and benefits of this investment over a number of years. In 2025-26, we plan to spend £173.1 million on capital investment. This spending will be funded by a combination of government grants, affordable borrowing, developer contributions and proceeds from the sale of assets.

Breakdown of income and expenditure by service committee area for capital spending

Breakdown of income and expenditure by service committee area

| Service committee area | Capital expenditure 2025-26 |

|---|

| |

£m |

| Adults and Health |

0.4 |

| Children and Families |

37.7 |

| Corporate Policy |

12.7 |

| Economy and Growth |

36.1 |

| Environment and Communities |

19.3 |

| Highways and Transport |

66.8 |

| Total |

173.1 |

Detailed budget information

Our budget pages give full details of our budgets. On these budget pages, some areas of spending have the same name as the service portfolio but show a different figure from that given on this page. This is because on the budget pages we break the spending down into a wider number of service areas. To read the full budget breakdown, see Cheshire East budget.

Local Precepts over £140,000 2025-26

Town and parish councils who plan to raise more than £140,000 from local Council Taxpayers are required to provide details of their gross expenditure. Those town and parish councils affected are detailed below:

Local Precepts over £140,000 2025-26

| Town / Parish Council | Gross Expenditure | Income & Reserves | Precept |

|---|

|

£ |

£ |

£ |

| Alderley Edge Parish Council |

595,330 |

430,330 |

165,000 |

| Alsager Town Council |

933,970 |

246,066 |

687,904 |

| Bollington Town Council |

508,434 |

70,434 |

438,000 |

| Congleton Town Council |

2,067,619 |

734,386 |

1,333,233 |

| Crewe Town Council |

1,573,878 |

133,082 |

1,440,796 |

| Disley Parish Council |

303,190 |

98,503 |

204,687 |

| Handforth Town Council |

275,002 |

105,002 |

170,000 |

| Holmes Chapel Parish Council |

318,102 |

38,110 |

279,992 |

| Knutsford Town Council |

1,026,265 |

209,585 |

816,680 |

| Macclesfield Town Council |

2,659,927 |

1,342,400 |

1,317,527 |

| Middlewich Town Council |

697,785 |

42,565 |

655,220 |

| Nantwich Town Council |

1,842,128 |

755,153 |

1,086,975 |

| Poynton with Worth Town Council |

728,695 |

69,600 |

659,095 |

| Prestbury Parish Council |

163,250 |

0 |

163,250 |

| Sandbach Town Council |

1,077,980 |

262,913 |

815,067 |

| Shavington-cum-Gresty Parish Council |

352,543 |

107,319 |

245,224 |

| Wilmslow Town Council |

1,011,656 |

328,361 |

683,295 |

Council Tax enquiry form

If you're unable to use our forms or have any questions about your bill you can call the Council Tax Customer Service Team on 0300 123 5013 between 8:30am to 2pm, Monday to Friday, excluding bank holidays.

Translate this page with Google translate

Page last reviewed: 10 September 2025

Thank you for your feedback.